From Labubus to lipstick sales, if you have been anywhere on the internet, you have heard about recession indicators. However, social media like TikTok isn’t discussing recession indicators in terms of economics, like an inverted yield curve, but rather changes in people’s behavior depending on their finances. But do these recession indicators actually mean anything?

First, what is a recession? Recessions are often defined as two quarters of decrease in the value of goods and services produced or GDP. Usually, they’re caused by a lack of spending, which leads to a decline in GDP, unemployment, and, in turn, higher interest rates and even more conservative consumer spending (Fidelity, 2025).

While some projections suggest we might be heading into a recession due to Trump’s recent tariff actions, we are not currently experiencing a wide-scale one (Helhoski, 2025). But that doesn’t mean we aren’t seeing a change in how people are spending their disposable income. Popular theories like the Lipstick and Hemline index are emerging with backing from the 1930s Great Depression.

The lipstick index says that sales of ‘affordable luxury’ items like lipstick, nail polish, and perfume increase during recessions (Mannion, 2025). Similarly, the theory that the appearance of collectables like Labubus, Sonny Angles, Smiskis, and many others has been linked to a lack of disposable income to spend on large purchases, so instead, smaller things are bought to bring joy in trying times (‘Recession indicators’ flood TikTok in US: Labubus, lipsticks and low-rise jeans trigger panic, 2025).

Another indicator of a recession is the Hemline index. The Hemline index states that when the economy is strong, skirts become shorter, and when the economy is in a downturn, longer and more conservative skirts are more popular (Fowler, 2025). With the recent trend of maxi skirts, it’s not surprising that this theory is gaining momentum.

But do these truly reflect anything substantial? The answer is no, not really. In a study in 2015, the hemline index was seen to have a 3-4 year lag, so longer skirts may indicate a previous decline, but not a future one (Fowler, 2025). Other changes in buying patterns have little direct evidence, so they’re not a great forecasting tool.

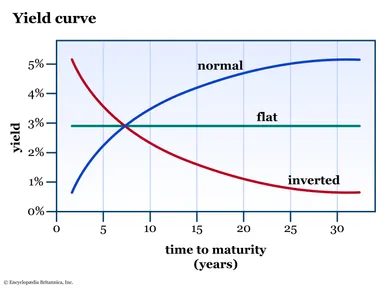

A true recession indicator with real backing is the presence of an inverted yield curve. Basically, a normal yield curve means borrowing money for longer periods of time means a higher yield or interest, and shorter periods have less yield, but an inverted yield curve will have the opposite. Short-term loans have a higher yield than long-term loans (Wessel; Alcalá Kovalski, 2025).

Personally, I think that times of large change often lead to rises in conservatism. If you look at culture wars that emerged in the 1920s, they were reactionary to sudden developments in freedoms, like women’s rights. Conservatism doesn’t always mean longer skirts, but I think there is definitely a correlation to unhappiness with the present and a tendency to romanticize and return to a more traditional past. Similarly, I think that while there’s probably not a direct correlation between Labubu sales and a drop in employment, it is definitely representative of cost-cutting. However, while you might become a statistic, but really, in the end, I think you should buy things that make you happy. While we may be in some tough times, the influx of little collectables isn’t the apocalyptic sign that TikTok makes it out to be, and you should find joy in the little things wherever you can.

Works Cited

Carlson, Debbie. “What’s the yield curve? Charting interest rates and the economy.” Encyclopedia Britannica, 6 Nov. 2025, https://www.britannica.com/

Carlucci, Jesse. “Are we currently in a recession?” Linkedin, 12 Sept. 2022, www.linkedin.com/pulse/we-

Cui, Jasmine. “Are we heading into a recession? Here’s what the data shows.” NBCnews, 17 Mar. 2025, www.nbcnews.com/data-graphics/

Duignan, Brian. “Causes of the Great Depression.” Encyclopedia Britannica, 13 Jun. 2025, https://www.britannica.com/

Duneja, Annika. “Labubus and lipstick: Why ‘recession indicators’ keep popping up on social media.” NBC Washington, 30 July 2025, www.nbcwashington.com/news/

“Economic Time.” ‘Recession indicators’ flood TikTok in US: Labubus, lipsticks and low-rise jeans trigger panic – The Economic Times, 1 Aug. 2025, economictimes.indiatimes.com/

Fowler, Emily. “What Is the Hemline Index, and Is It an Accurate Recession Indicator?” Nasdaq, 25 May 2025, www.nasdaq.com/articles/what-

—. “What Is the Hemline Index, and Is It an Accurate Recession Indicator?” Yahoo, 2025, finance.yahoo.com/news/

Helhoski, Anna. “Are We in a Recession?” Edited by Rick VanderKnyff. Nerdwallet, 29 Oct. 2025, www.nerdwallet.com/finance/

Mannion, Mary. “What is the lipstick index?” Chase, 5 June 2025, www.chase.com/personal/

Rosalsky, Greg. “Is All This Talk of Recession Indicators a Sign a Recession Is Coming?” NPR, 10 June 2025, www.npr.org/sections/planet-

Thompson, Moxie. “US Economy is Headed for Recession.” BIPR, bipr.jhu.edu/BlogArticles/22-

Wessel, David, and Manuel Alcalá Kovalski. “Commentary The Hutchins Center Explains: The yield curve – what it is, and why it matters.” Brookings, 8 Dec. 2018, www.brookings.edu/articles/

“What’s a recession, and how does it work?” Fidelity, Fidelity Brokerage Services LL, www.fidelity.com/learning-